Is the launch of Bitcoin spot ETFs in 2024 not having the anticipated impact? Many believed these ETFs would be a game-changer for the cryptocurrency Market, but it seems that may not be the case. Stay tuned for more insights on this topic.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Grayscale’s Bitcoin ETF saw a negative outflow of over $43M, causing outflows in other products as well. Surprisingly, Bitcoin’s Market remained relatively unaffected by this development.

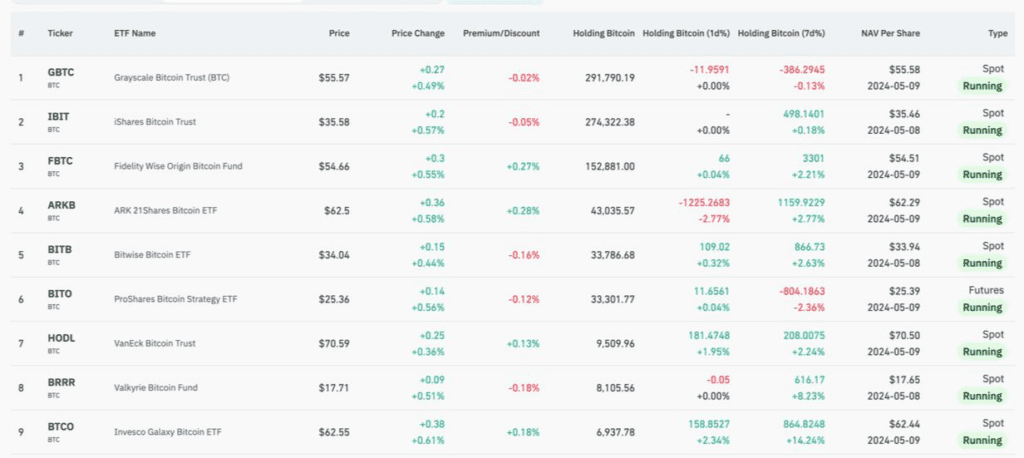

Recent data from Coinglass indicated a concerning trend for Grayscale’s GBTC, with $43.4 million exiting the fund. Despite this, GBTC experienced a $60 million influx last Friday, showcasing its continued Market presence. Meanwhile, BlackRock’s IBIT Bitcoin ETF received $14.2 million in inflows, suggesting growing investor confidence. Fidelity’s Wise Bitcoin ETF also saw a boost of $2.7 million.

Bitwise’s BITB ETF attracted $6.8 million in investments, distinguishing itself as a top choice among investors. In contrast, Ark 21shares (ARKB) ETF received a wave of $4.4 million in support. While WisdomTree’s BTCO and Franklin Templeton’s EZBC Bitcoin ETFs experienced more modest gains, with inflows of $2.2 million and $1.8 million respectively.

Grayscale has been the biggest loser, witnessing a substantial $17.2 billion withdrawal since its inception. Despite cutting fees, Grayscale’s charges remain higher than its competitors, who typically have expense ratios around 0.20%-0.25%.

There’s also been a decline in interest in crypto ETF products globally. Hong Kong’s spot Bitcoin ETFs saw outflows of over $5.5 million in 24 hours, reflecting a general disinterest in these products.

In the midst of this, Bitcoin managed to hold steady above $63,000, with a 4% increase in the last 24 hours. The community remains largely bullish on BTC, according to data from CoinGecko.

The ongoing exit of smaller investors could potentially pave the way for a resurgence in Bitcoin and other cryptocurrencies as summer approaches. This hints at a possible reset in the volatile cycles of the crypto Market.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is a Bitcoin spot ETF?

A Bitcoin spot ETF is an exchange-traded fund that allows investors to buy and sell shares that represent a certain amount of actual Bitcoin.

2. Why is the Bitcoin spot ETF not considered a catalyst in 2024?

The Bitcoin spot ETF was expected to spark a major influx of institutional money into the cryptocurrency Market in 2024, but it did not meet those expectations due to regulatory hurdles and other factors.

3. Can I still invest in Bitcoin without a spot ETF?

Yes, you can still invest in Bitcoin through exchanges, online platforms, and other investment vehicles without needing to rely on a spot ETF.

4. Are there any alternative ways to invest in Bitcoin besides a spot ETF?

Yes, you can invest in Bitcoin through futures contracts, options, trusts, and other financial products that offer exposure to the cryptocurrency Market.

5. Will the Bitcoin spot ETF be a game-changer in the future?

While the Bitcoin spot ETF may still have the potential to significantly impact the cryptocurrency Market in the future, it is not currently considered the catalyst that many expected it to be in 2024.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators