Marathon Digital saw a slip in its stock price after reporting lower-than-expected earnings. The cryptocurrency mining company fell short on revenue projections, causing investors to react. The company’s performance in the latest quarter has raised concerns among analysts and shareholders.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Marathon Digital (NASDAQ:MARA) shares saw a dip in after-hours trading following the release of their first-quarter results. Despite beating analysts’ earnings per share estimate of $0.03 with $1.26 per share, the company missed revenue expectations at $165.2 million compared to the anticipated $180.7 million.

The growth in revenue was attributed to increased Bitcoin (BTC-USD) production and a rise in BTC prices. MARA upped its BTC production by 28% to 2,811 BTC and saw a 126% year-over-year increase in the average price of mined bitcoin. Additionally, the company expanded its hash rate capacity to 27.8 EH/s from 11.5 EH/s in Q1 2023.

By the end of March 2024, Marathon held cash and BTC totaling $1.6 billion and plans to further boost its hash rate capacity to 50 EH/s.

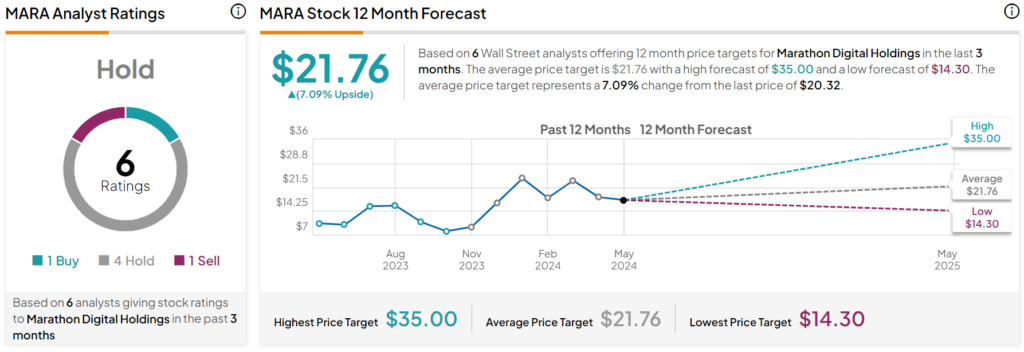

With a nearly 100% surge in share price over the past year, MARA has garnered a Hold consensus rating from analysts, with an average price target of $21.76. However, the recent earnings report might lead to changes in analysts’ perspectives on the stock.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is MARA Earnings?

MARA Earnings refers to the financial performance and results reported by Marathon Digital Holdings, a company engaged in cryptocurrency mining operations.

2. Why did Marathon Digital’s stock price slip after reporting their earnings?

Marathon Digital’s stock price slipped after reporting earnings because their revenue fell short of expectations, causing investors to react negatively.

3. How does Marathon Digital make money?

Marathon Digital makes money through cryptocurrency mining, which involves solving complex mathematical problems to validate transactions on blockchain networks and earn digital currencies as rewards.

4. What factors can affect Marathon Digital’s earnings?

Factors that can affect Marathon Digital’s earnings include fluctuations in the price of cryptocurrencies, changes in mining difficulty levels, and regulatory developments impacting the cryptocurrency industry.

5. Should investors be concerned about Marathon Digital’s earnings performance?

Investors should consider a range of factors, including the company’s growth prospects, Market conditions, and competitive landscape, when evaluating Marathon Digital’s earnings performance and making investment decisions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators