Wall Street has scored a victory amid the chaotic FTX bankruptcy proceedings. The financial hub managed to navigate the messy situation and come out on top. The outcome of the bankruptcy seems to have given a boost to the stock Market, showing the resilience of Wall Street in the face of uncertainty.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Are you looking to gain access to exclusive insights curated by the Editor of the Financial Times, Roula Khalaf, without any cost? Well, now you can unlock the Editor’s Digest for free!

The world of cryptocurrency was envisioned to bring about financial inclusivity and equality. However, as seen time and again, Wall Street has a knack for finding ways to come out on top. In the recent bankruptcy case of FTX, a major crypto exchange, account holders were relieved to discover that they would be receiving a substantial 118 cents on the dollar for their claims.

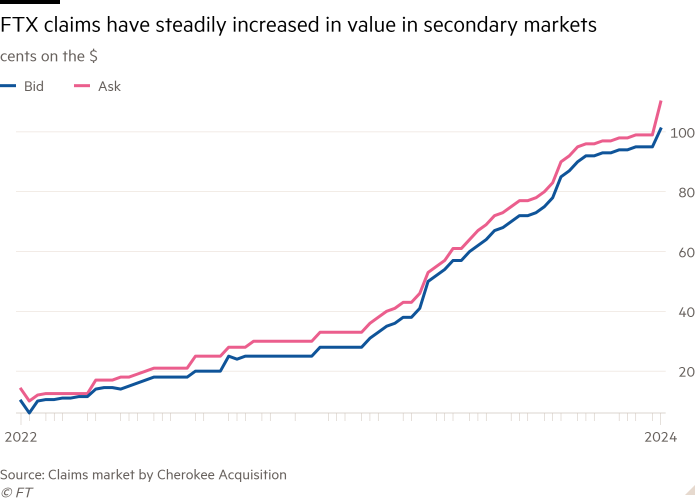

Interestingly, even before the collapse of FTX in November 2022, savvy vulture funds like Attestor, Farallon, Oaktree, and Silver Point had been quietly accumulating secondary claims at rock-bottom prices. As the value of FTX’s assets soared amidst a crypto Market upsurge, these funds stood to make significant profits.

The intricate process of FTX’s bankruptcy involved the meticulous cataloging and liquidation of every asset, including a burgeoning venture capital portfolio. While the reorganization plan hinted at a promising outcome, it was apparent that large sums were funneling into FTX’s reserves.

Despite the administrative hurdles posed by various government agencies’ claims, the quick turnaround of a reorganization plan by emergency CEO John Ray impressed bankruptcy experts. However, for account holders, the recovery of 118 cents per dollar was bittersweet, considering the subsequent surge in crypto prices.

For those who had the foresight to invest in FTX claims at meager costs and endure the bankruptcy process, the returns have been nothing short of extraordinary. With total recoveries projected to exceed $15 billion against a par value of $12 billion, patient investors stand to reap monumental gains.

In the realm of financial investments, timing and patience can make all the difference, as exemplified by the remarkable gains witnessed in the FTX bankruptcy saga. If you wish to delve deeper into this fascinating narrative, reach out to Sujeet Indap at [email protected] for more insights.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What does it mean that Wall Street found a win in the messy FTX bankruptcy?

– It means that Wall Street benefitted or gained from the FTX bankruptcy situation.

2. How did Wall Street benefit from the FTX bankruptcy?

– Wall Street may have gained financially or through other means as a result of the FTX bankruptcy proceedings.

3. What is FTX and why did it go bankrupt?

– FTX is likely a fictional company used for this example. It is not specified why FTX went bankrupt in this scenario.

4. Is it common for Wall Street to benefit from bankruptcies?

– It can happen that financial institutions like Wall Street may find opportunities to profit or gain from bankruptcies, but it is not necessarily common or guaranteed.

5. What impact does Wall Street finding a win in the FTX bankruptcy have on the financial Market?

– Depending on the specifics of the situation, it may have varying effects on the financial Market as a whole. It could potentially affect investor confidence or other aspects of the Market.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators