Is it time to consider investing in Rivian stock? Wall Street analysts are offering their insights on the electric vehicle company’s potential. Learn more about what experts are saying and whether now is the right time to load up on Rivian stock.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Electric vehicle maker Rivian (NASDAQ:RIVN) saw its stock fluctuate today, initially dropping around 10% before recovering to close near breakeven. The reason behind this volatility was the release of its Q1 earnings report.

On the revenue front, Rivian exceeded expectations with a year-over-year increase of 81.5% to $1.2 billion, outperforming consensus estimates by $30 million. However, the company reported a larger-than-expected loss, with adjusted EPS coming in at -$1.24, missing analysts’ forecasts by $0.08.

Adjusted free cash flow also fell short, showing a deficit of $1.523 billion compared to a consensus of -$941 million. Rivian attributed this to higher Accounts Receivable and Inventory levels, expected to decrease as the year progresses.

For each vehicle delivered in the quarter, Rivian incurred a loss of $38,784. The company also reported a larger gross profit miss than anticipated, recording -$527 million against a consensus of -$348 million. This figure included $171 million in costs and accelerated depreciation, which management expects to disappear by Q4.

Despite these challenges, Rivian remains optimistic about achieving a modest gross profit in Q4 and reiterated its production target of 57,000 vehicles for the year. The company also reduced its capex guidance by $500 million to $1.2 billion, opting to proceed with R2 production in Illinois while postponing a new facility in Georgia.

Analysts are divided in their outlook for Rivian. RBC’s Tom Narayan emphasizes the importance of a successful ramp-up of R2 and R3 models, expressing concern about competition from traditional automakers. Conversely, Stifel’s Stephen Gengaro remains bullish on Rivian, highlighting the company’s progress in optimizing expenses.

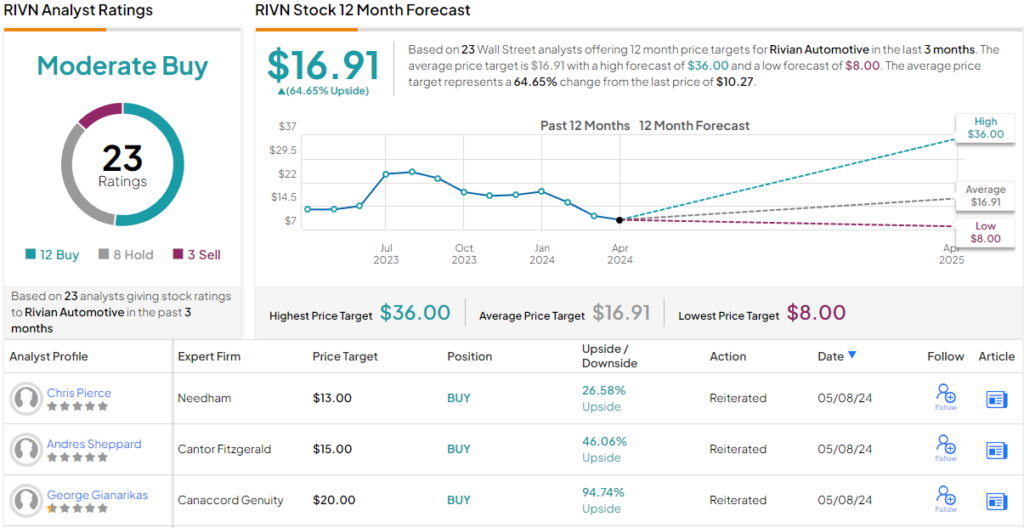

Overall, Wall Street sentiment leans towards the bullish side, with a Moderate Buy consensus rating based on 12 Buy, 8 Hold, and 3 Sell ratings. The average price target of $16.91 implies a potential return of approximately 65% over the next 12 months.

Investors should conduct their own research before making any investment decisions. The opinions expressed in this article are those of the featured analysts and are for informational purposes only. For more stock recommendations, check out TipRanks’ Best Stocks to Buy tool.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. Q: Is now a good time to invest in Rivian stock?

A: It depends on your investment strategy and risk tolerance. It’s always best to do thorough research and consult with a financial advisor before making any investment decisions.

2. Q: What are Wall Street analysts saying about Rivian stock?

A: Wall Street analysts have varying opinions on Rivian stock, with some recommending it as a buy and others suggesting caution. It’s important to consider multiple perspectives before making a decision.

3. Q: How has Rivian stock performed in the past?

A: Rivian went public in November 2021, and its stock price has experienced fluctuations since then. Past performance is not always indicative of future results, so it’s important to consider other factors as well.

4. Q: What are some risks associated with investing in Rivian stock?

A: Like any investment, there are risks involved with investing in Rivian stock. These include Market volatility, company-specific risks, and general economic factors that may impact the stock price.

5. Q: How can I stay informed about Rivian stock updates?

A: You can stay informed about Rivian stock updates by following financial news outlets, subscribing to stock Market newsletters, and monitoring Rivian’s investor relations website for the latest information.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators