Bitcoin has been on a wild ride lately, with its price surging an impressive 280% from its cycle lows. This dramatic increase mirrors previous bull cycles, indicating that the cryptocurrency’s upward trajectory is far from over. Investors and enthusiasts alike are closely watching as Bitcoin continues to defy expectations and reach new heights.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

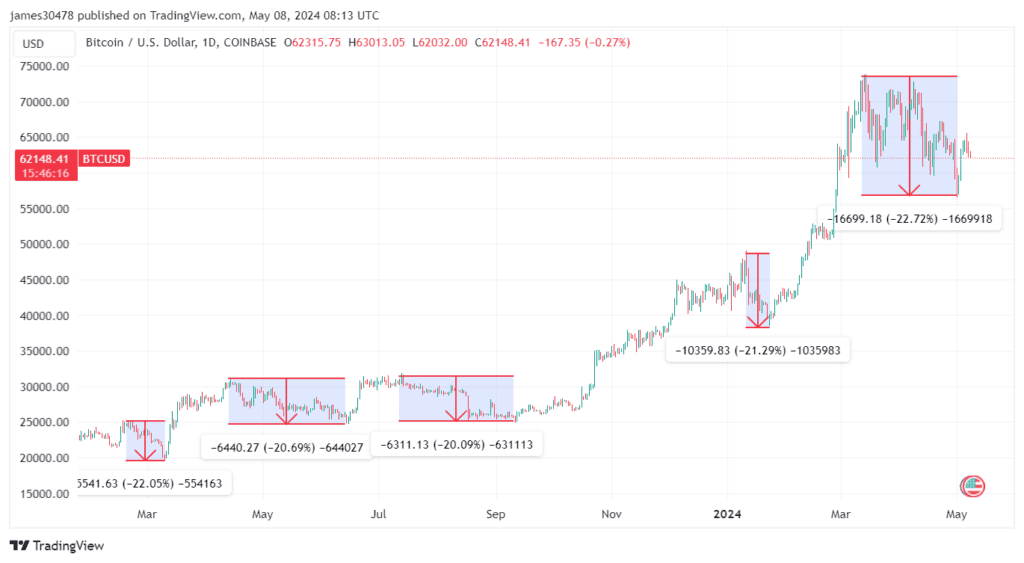

Bitcoin’s price has been steadily increasing since it hit a low point of $15,500 in November 2022. This upward trend resulted in new all-time highs in March 2024, showcasing a remarkable 280% surge from its lowest point in the cycle. However, despite this bullish trajectory, there have been several significant corrections in the Market.

In March 2023, Bitcoin experienced a 22% drawdown, followed by a 20% correction lasting from April to June 2023. Another 20% pullback occurred between July and September 2023. After the introduction of a Bitcoin ETF in January 2024, the Market witnessed a correction of just over 20%. Most recently, Bitcoin retraced 23% from its peak in March 2024, falling to around $56,500 at the beginning of May.

The current cycle low reflects a similar recovery pattern seen in the 2015/2018 cycle, with both showing around 280% growth at this stage. Subsequently, the earlier cycle surged over 11,000% from its lowest point. Compared to the low of the 2018/2022 cycle, the current cycle has rebounded about 190% by this stage. Projections indicate that the current Bitcoin cycle is on a positive trajectory, aligning well with historical trends.

In summary, Bitcoin’s performance has seen significant growth and corrections in recent months, with the Market showing resilience amidst volatility. The data suggests a promising outlook for the current cycle, with potential for substantial gains ahead.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What caused Bitcoin to surge by 280% from its cycle lows?

Many factors contributed to Bitcoin’s surge, including increasing adoption by institutional investors and growing interest in cryptocurrencies.

2. Is Bitcoin’s current price increase similar to previous bull cycles?

Yes, Bitcoin’s 280% surge from its cycle lows mirrors previous bull cycles, suggesting a pattern of growth and volatility in the cryptocurrency Market.

3. Should I invest in Bitcoin now that it has surged so much?

Investing in Bitcoin carries risks, as its price can be highly volatile. It’s important to do thorough research and consider your own risk tolerance before investing.

4. How can I buy Bitcoin?

You can buy Bitcoin on cryptocurrency exchanges or through peer-to-peer platforms. Make sure to choose a reputable exchange and secure your Bitcoin in a wallet.

5. What factors could impact Bitcoin’s price in the future?

Various factors, such as regulatory developments, technological advancements, and Market sentiment, could impact Bitcoin’s price in the future. It’s important to stay informed and monitor the cryptocurrency Market closely.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators