Ethereum’s implied volatility is on the rise, providing valuable insights for traders. Learn more about what the data is telling us in this latest update from TradingView News.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

The cryptocurrency Market is showing distinct differences in the behavior of Bitcoin and Ethereum. While Bitcoin is moving towards stability, Ethereum is facing continued uncertainty, especially in its options Market.

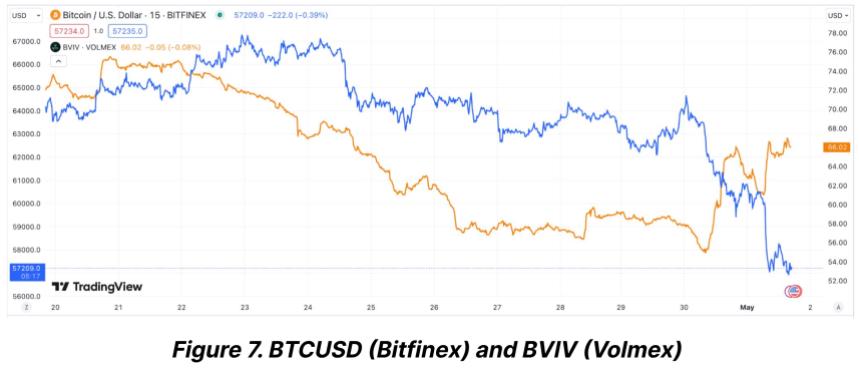

Implied volatility is a key indicator in the options Market, showing the expected price movements of an asset. Recent data shows that Bitcoin’s implied volatility has calmed down after the halving, but Ethereum’s remains high. This discrepancy reflects a cautious outlook among investors regarding Ethereum’s future price movements.

Bitcoin’s volatility index has decreased significantly post-halving, while Ethereum has only seen a modest reduction. This ongoing volatility in Ethereum is driven by uncertainties around upcoming regulatory decisions and broader Market implications.

The Ethereum Market is jittery ahead of the SEC’s decision on two spot Ethereum ETFs scheduled for late May 2024. This regulatory milestone could trigger a major Market shift or worsen the current volatility.

Both Ethereum and Bitcoin have shown signs of recovery in trading performance, with Bitcoin seeing a 4.1% increase and Ethereum a 2.4% gain over the past week. However, Ethereum experienced a slight dip of 0.7% in the last 24 hours, highlighting the volatility and investor caution in the Market.

Ethereum’s network activity has also slowed down, with a decrease in ETH burn rate due to lower transaction fees. This technical aspect adds to the narrative of a cautious Ethereum Market on the verge of potential significant changes based on external regulatory actions.

Analysts like Ashcrypto suggest that the current volatility could lead to a strong rebound in the third quarter of the year, with Ethereum potentially reaching the $4,000 mark if Market conditions align favorably.

Overall, the cryptocurrency Market is navigating through varying levels of volatility, with Ethereum facing uncertainties while Bitcoin shows more stability. Factors like regulatory decisions and Market dynamics will continue to influence the future performance of these leading assets.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

1. What is ETH implied volatility?

Implied volatility is a measure of how much the Market thinks the price of Ethereum (ETH) will fluctuate.

2. Why is ETH implied volatility important for traders?

High implied volatility suggests that the price of ETH is expected to have large swings, which can present both opportunities and risks for traders.

3. How can traders use ETH implied volatility in their trading strategy?

Traders can use implied volatility to help gauge the potential risk and reward of trading ETH, and adjust their strategy accordingly.

4. How does ETH implied volatility compare to historical volatility?

Implied volatility reflects the Market‘s current expectations for future price movements, while historical volatility looks at past price movements.

5. Should traders always trade based on ETH implied volatility?

While it can be a useful tool, traders should consider other factors in addition to implied volatility when making trading decisions.

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators

Win Up To 93% Of Your Trades With The World’s #1 Most Profitable Trading Indicators